Of those planning to make increases in investment to renewable energy over the next year, 8% will make increases of 4-6%; 12% say they will raise allocations by 7%; 21% will make increases of 8% and the majority (59%) expect to increase by more than this.

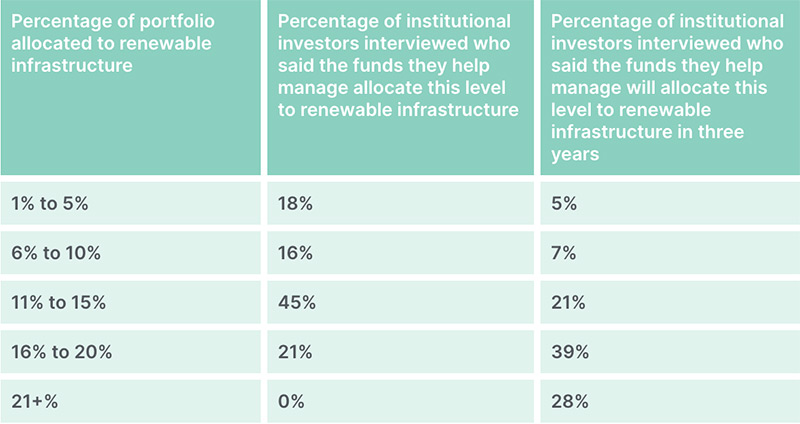

The bulk (45%) of respondents’ current allocations to renewable energy are between 11 and 15%. 21% say they invest 16-20% in renewable energy; 16% of respondents invest 6-10%; and 18% of investors allocate between 1-5%.

In the next three years, UK pension funds and insurers predict allocations will be significantly higher than today. 5% say they will boost allocations by 1-5%; 7% say 6-10%; one fifth (21%) say 11-15%; two-fifths (39%) say 16-20%; while just over a quarter (28%) say allocations will increase by 21% or more.

Looking at returns from unlevered renewable assets net expenses, 5% of UK pension funds expect between 2.5-5% per annum; more than half (54%) say between 5-7.5%; more than a third (38%) expect 7.5-10%; while 3% look for returns in excess of 10% a year.

When asked to select their top three reasons for investing in renewable infrastructure assets, the vast majority of respondents (85%) cited income generation. Almost three-quarters (71%) said they use renewable assets to diversify their portfolio, and more than two-thirds (68%) of investors interviewed cited that the asset class is a way to align with their ESG investment objectives.

Over two-fifths (44%) of respondents say renewable assets are a good means to generate long-term cash flows, while one third (32%) are motivated by the return potential.

In terms of need for immediate yield post investment, 88% of respondents say this is a requirement while 12% say it is not.

Allocations to renewable infrastructure

Percentage of portfolio allocated to renewable infrastructure

Percentage of institutional investors interviewed who said the funds they help manage allocate this level to renewable infrastructure

Percentage of institutional investors interviewed who said the funds they help manage will allocate this level to renewable infrastructure in three years

1% to 5%

18%

5%

6% to 10%

16%

7%

11% to 15%

45%

21%

16% to 20%

21%

39%

21+%

0%

28%

Stuart Hanson, Associate Director, Client Solutions, AlphaReal said: “Pension funds and insurers’ growing appetite for renewable infrastructure recognises that these assets can provide an attractive risk-adjusted return alongside positively contributing towards the transition to clean energy.”

Ed Palmer, CIO and Head of Sustainability, AlphaReal said: “AlphaReal has a long track record in managing renewable infrastructure. We can offer our clients flexibility in how investments are structured and manage renewable infrastructure allocations either within our existing funds or by creating bespoke mandates. By diversifying investment across low carbon technologies such as wind, solar, and energy storage, working with quality counterparties we aim to provide high levels of contracted, index-linked cash flows that match our investors’ liability profiles.”