We focus on new build and change of use assets, which recognises the embodied carbon, to deliver future-fit assets for 25+ years. Our long-term approach supports positive environmental and social impact outcomes.

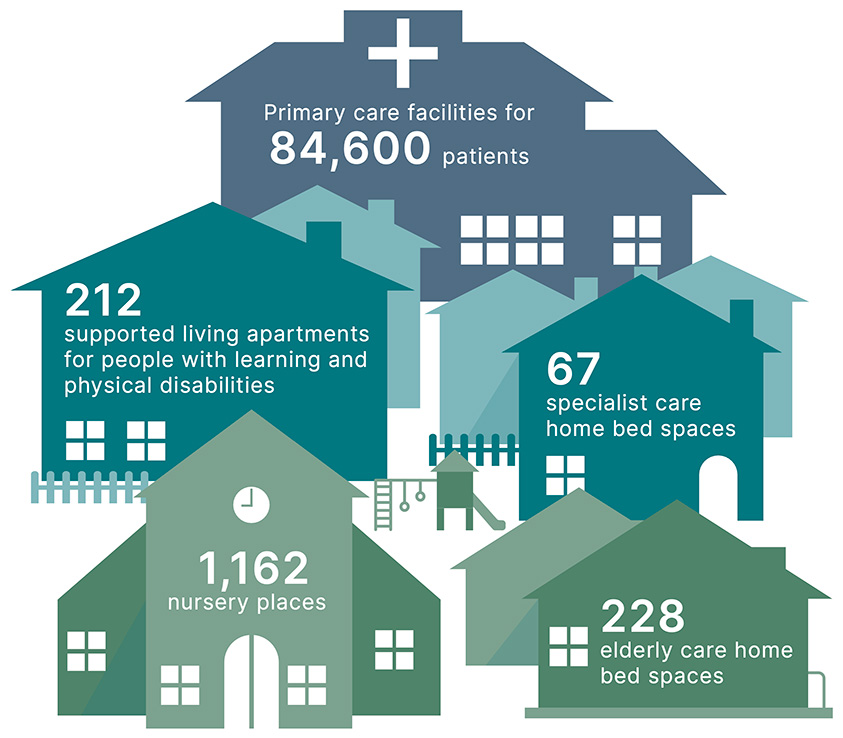

Our approach enables additional provision of essential needs-based services to assist the wellbeing of communities in the UK. We support alignment of institutional capital and public funding to alleviate capacity constraints across our three pillars of health, housing and education.

We generate market returns by investing in long-lease real estate with predominately inflation-linked rents using caps and collars to support the affordability for tenants and the delivery of income growth for investors.

We focus on new build and change of use assets, which recognises the embodied carbon, to deliver future-fit assets for 25+ years. Our long-term approach supports positive environmental and social impact outcomes.

Our approach enables additional provision of essential needs-based services to assist the wellbeing of communities in the UK. We support alignment of institutional capital and public funding to alleviate capacity constraints across our three pillars of health, housing and education.

We generate market returns by investing in long-lease real estate with predominately inflation-linked rents using caps and collars to support the affordability for tenants and the delivery of income growth for investors.