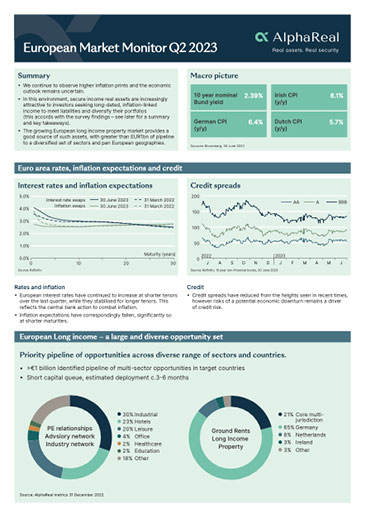

The growing European long income property market provides a good source of such assets, with greater than EUR1bn of pipeline to a diversified set of sectors and pan European geographies.

AlphaReal identifies ‘speed of deployment’ as biggest obstacle to renewable infrastructure investment

A survey of UK pension funds and insurers that collectively oversee over £350 billion in assets, commissioned by AlphaReal, the specialist manager of secure income real assets, reveals that it is the speed of deployment that is the biggest obstacle to investing in renewable infrastructure.