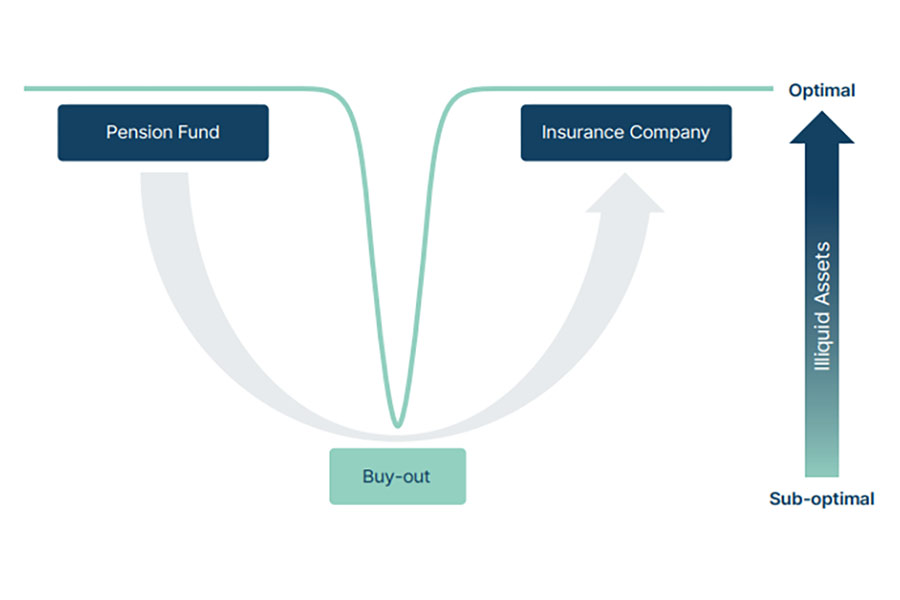

AlphaReal, the specialist real assets investment manager, cautions that as more UK pension funds can afford to buy-out liabilities with an insurer, they face the threat of what it calls a ‘liquidity kink’. This is where they are forced to sell illiquid assets prior to transacting with an insurance company, while the insurer is likely to use the cash or gilt assets transferred to buy very similar assets to those that were recently sold by the pension scheme. This is particularly true for assets that are a good match for long-dated and inflation-linked liabilities. The ‘liquidity kink’ leads to inefficiency and higher costs that are ultimately borne by pension scheme members.

AlphaReal suggests that this ‘liquidity kink’ will impact many of the pension funds now moving into surplus as a result of higher rates. Consultancy LCP estimates that almost 18% of schemes are fully funded on a buy-out basis, and 45% are at least 90% funded.

Many more pension schemes will be faced with the ‘liquidity kink’ than anticipated.

But AlphaReal says schemes can take advantage of a market more willing to accommodate illiquid assets in buy-out transactions. AlphaReal suggests six approaches to illiquid asset holdings that schemes can consider for a more efficient, cost-effective buy-out.

Redemption of units in normal timeframes

For example, a six-to-12-month timeframe can be enough given how long buy-out transactions take.

Premium payment

It is common for insurers to allow a small amount (up to 5%) of the premium to be paid at the end of the post-transaction data cleansing period, typically a 12-to-18-month process. Combined with the time it takes to plan and implement a transaction, a scheme could have up to two years to make good the last 5% of the premium, which provides considerable additional flexibility to sell illiquid assets.

Deferred premium

Where schemes need further flexibility, some insurers offer the ability to defer more of the premium for longer. For example, it might be possible to defer up to 10% of the premium for five years. Some insurers also offer lots of flexibility around when the deferred amount is paid, for example making good the whole amount deferred only at the end of the deferral period. There would likely be an interest charge for premium deferral, but it is then straightforward to undertake a cost-benefit analysis of the deferral.

Deferred start

Under this option, a scheme only ensures its future benefit payments starting ‘N years’ from transacting. As the first ‘N years’ cash flows remain a liability of the scheme, the buy-out premium payable is lower, and this could be structured so the premium is at a level that avoids the need to sell illiquid assets. However, the scheme does still need to meet benefit cash flows in the first ‘N years’. If the scheme’s illiquid assets provide income, this could be used to meet those cash flows. There may be other options such as short-term finance or borrowing from the sponsoring employer that could bridge the gap to fund those cash flows and avoid selling illiquid assets. Deferred start solutions are typically more suitable for more mature schemes with a decent proportion of their liabilities relating to retired members.

Financing

Where a deferred premium or deferred start are not feasible or desirable options, a scheme could look to borrow against the illiquid assets to provide the liquidity so that the buy-out premium can be met in full, but without the scheme having to sell illiquid assets with a haircut.

Sponsor asset transfer

A scheme’s trustees and sponsor would need to take appropriate advice, but it may be an option for the sponsor to agree to take any illiquid assets, to avoid the need to sell them. In return, the sponsor would provide the scheme with the funds to meet the insurance premium. This is likely only to be an option for larger employers and where the illiquid asset is material enough to make this worthwhile.

Shajahan Alam, Head of Strategic Investment Solutions at AlphaReal and author of the paper said: “The ‘liquidity kink is a live phenomenon for many pension schemes, what is encouraging though is that the industry is actively innovating to accommodate illiquid assets in buy-out transactions. This is underpinned by the growing appetite from insurers to hold illiquid assets. This bodes well for schemes with a longer investment horizon, as they can more confidently take advantage of the illiquidity premium knowing that insurers are becoming more open to taking on the right kind of assets as part of a buy-out transaction.”

Phillip Rose, CEO of AlphaReal said: “Secure income real assets continue to increase their appeal to a wider investor base. This is due to their liability matching nature and the resilience they can bring to both pension fund and insurer portfolios. AlphaReal sees increasing opportunities for secure income assets to transit between pension funds and insurers as part of the buy-out process.”.

To help pension schemes manage any ‘liquidity kink’, AlphaReal has published a paper, ‘The liquidity kink revisited – illiquid assets and buy-out transactions’, which is available for free at The-Liquidity-Kink-Revisited.pdf (alphareal.com)